You may be considering leasing a new car for the first time. Perhaps you’ve leased before and have stumbled across this blog as you began your search for your next lease. Leasing is growing rapidly due to the current economic climate and auto industry promotion. The convenience of leasing will cost you more, but it doesn’t have to cost more than necessary.

You may be considering leasing a new car for the first time. Perhaps you’ve leased before and have stumbled across this blog as you began your search for your next lease. Leasing is growing rapidly due to the current economic climate and auto industry promotion. The convenience of leasing will cost you more, but it doesn’t have to cost more than necessary.

The two most important factors that can lower your lease payments is the price of the car (the agreed value), and the money factor (like an interest rate) for your lease. Both are set by the dealer and can be reduced through dealer competition.

1. Price

Typical lease advertisements highlight the characteristically low monthly payment and draw a comparison to higher loan payments. The price of the car is often set near the manufacturer’s suggested retail price (MSRP) and presented in the small (but legal) print—almost like a condition for the lease. When you accept the advertised deal, you get the lower-than-loan payments but pay much more than necessary. Ignore the advertising and stay focused on obtaining the best price for your new car.

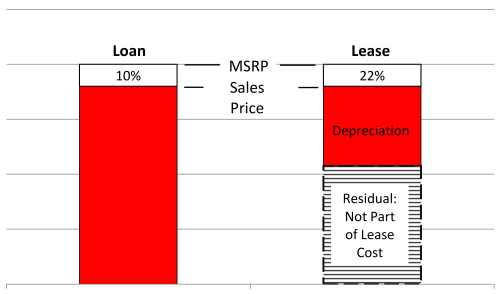

Whether you loan or lease, a low price is important, but notice the much bigger impact of price on the cost of your lease in the figure below. A reduction in sales price of only 10% below MSRP results in a reduced lease cost (cost of depreciation) of nearly 22%, resulting in a reduction in your monthly payment of 21%! A small reduction in price yields a much larger reduction in lease cost because you only pay for the amount of the car’s value that deprecates during your lease term.

The figure is based on a residual rate of 54% and consistent money factor values. As the residual rate goes up, the impact of a reduce price also goes up (total deprecation cost goes down).

2. Money Factor

Money factor is equivalent to the interest rate for a loan. It’s easy to convert from one to the other for comparison purposes.

Money Factor = Annual Interest Rate ÷ 2400

For example, a money factor of 0.002 is equivalent to an annual interest rate of 4.9%.

Money factors, just like interest rates, are set by financing companies based on your credit score. Dealers often add a financing rate mark-up to both. This mark-up can often translate into thousands of dollars of additional cost, even for the shorter term of the typical lease.

It’s fairly easy to comparison shop loan interest rates; however, most leasing is done though the dealership using auto manufacturer finance companies. All is not lost, however, because manufacturer base money factor rates (bid rates) can sometimes be obtained and can empower your position as a consumer. Preapproved credit union or bank leases, if available, will also give you buying power.

Two potential sources for auto manufacturer money factor bid rates include the Ride with G Auto Leasing Demystified website and the Prices Paid—Buying & Leasing Experiences forum on Edmunds.com.

G publishes everything he receives and he has quite a listing. Kyfdx is the current host on the Edmunds.com forum and will answer polite requests for the lease bid rate information. Find the forum for your make and model and ask away. You’ll need to register to post, but that’s easy and free. Once you get your new car, share your results with the forum. It will make the experience richer for everyone.

Are You New To Leasing?

If you’re new to leasing, please be aware that there are many additional aspects to obtaining a good deal on a lease. You’ll find everything you need to be successful in my new book Power Shift with an included complete, concise, and easy-to-read 21-page guide to leasing (Appendix C, More About Leasing). The Ride with G website is also very accessible for a beginner. For an exhaustive study of auto leasing, take a look at leaseguide.com.

You may also want take a look at a very interesting article titled What I learned the Hard Way About Leasing a Car written by first-time leaser and New York Times Chief Information Officer, Marc Frons. He describes his experience and missteps, and has also posted his lease contract online—a rare opportunity if you’ve never seen one.